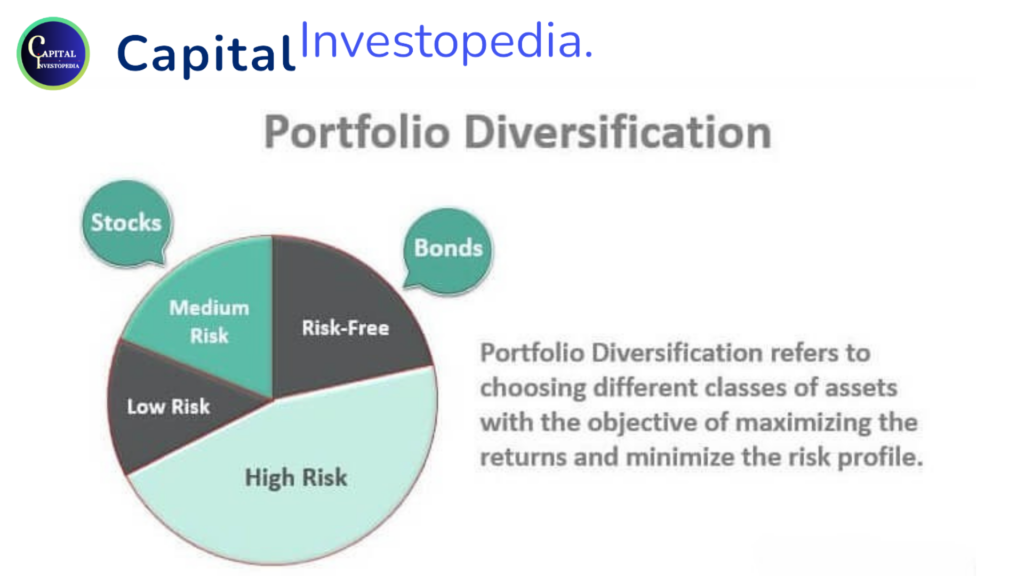

Diversification is a fundamental and widely recognized principle in the world of investing and finance. Its importance lies in its ability to manage risk and improve the risk-return trade-off in an investment portfolio.

Basic reasons why diversification is crucial for investors –

Risk Reduction: The primary goal of diversification is to reduce risk. By spreading investments across a range of different assets or asset classes, you decrease the potential impact of poor performance from any single investment. When one asset underperforms, others may perform better, helping to offset losses and reduce overall portfolio volatility.

Minimizing Idiosyncratic Risk: Diversification helps minimize idiosyncratic risk, which is the risk specific to individual investments or companies. This includes risks like bankruptcy, management issues, or industry-specific problems. By owning a variety of investments, you’re less vulnerable to the problems of a single company or sector.

Enhanced Consistency: Diversification can lead to more consistent and stable returns over time. While individual assets may experience fluctuations in value, a diversified portfolio is less likely to exhibit extreme ups and downs. This consistency can make it easier for investors to stay the course during market turbulence.

Volatility Smoothing: A diversified portfolio typically exhibits smoother volatility. While some assets may experience significant price swings, others may be relatively stable. The combination of assets can help reduce the overall volatility of the portfolio, providing investors with a more predictable investment experience.

Risk-Return Trade-Off: Diversification can help investors achieve a better balance between risk and return. While it might limit the potential for outsized gains, it also reduces the risk of substantial losses. For long-term investors, this balanced approach can be particularly attractive.

Correlation Mitigation: Diversification can reduce correlation risk. In other words, assets in a diversified portfolio should ideally not move in the same direction at the same time. For example, during a stock market downturn, certain assets like bonds might perform better due to their inverse relationship with equities.

Reduction of Market Timing Risk: Attempting to time the market by buying and selling assets at the right moment is challenging and often unsuccessful. Diversification allows investors to participate in various markets and asset classes over time, reducing the need for precise market timing.

Customization: Diversification is a flexible strategy that can be tailored to an investor’s specific financial goals, risk tolerance, and time horizon. The mix of asset classes and individual investments can be adjusted to match an individual’s unique circumstances and objectives.

Long-Term Wealth Accumulation: Diversification is particularly important for long-term wealth accumulation. It helps protect and grow an investment portfolio over time, allowing investors to benefit from the historical trend of financial markets to rise over the long run.

Risk Management in Retirement: For retirees, diversification is essential to help preserve capital and generate a steady stream of income. A diversified portfolio can be designed to balance the need for income with the preservation of capital.

Professional Advice: Many financial advisors and investment professionals recommend diversification as a core strategy in building and managing portfolios. They can help investors construct well-diversified portfolios based on their unique financial circumstances.