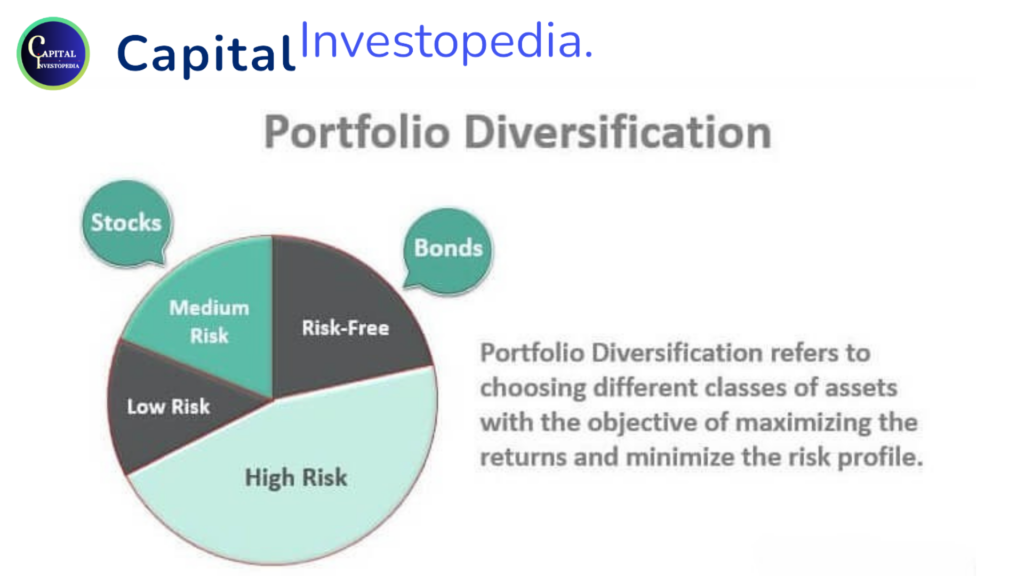

Portfolio diversification is a risk management strategy used by investors to reduce the potential for significant losses by spreading their investments across a variety of different assets or asset classes. The idea behind diversification is to limit exposure to any single investment or type of asset, thereby lowering overall risk while aiming to achieve a more stable and consistent return on investment.

Basic concepts and benefits of portfolio diversification –

1. Asset Classes: Diversification typically involves investing in different asset classes, such as stocks, bonds, real estate, commodities, and cash or cash equivalents. Each asset class has its own risk-return profile, and they tend to perform differently under various economic conditions.

2. Individual Investments: Within each asset class, diversification can also extend to holding a mix of individual investments. For example, in the stock market, diversification might involve owning shares in companies from different industries and geographical regions.

3. Risk Reduction: The primary objective of diversification is to reduce the risk associated with investing. By spreading investments across various assets, investors can avoid the concentration of risk in a single investment. When one asset performs poorly, others may perform well, helping to offset losses.

4. Volatility Smoothing: Diversification can help smooth the volatility of a portfolio. While individual assets may experience price fluctuations, a diversified portfolio is less likely to exhibit extreme ups and downs. This can make the portfolio less stressful to manage and easier to stay invested in during market fluctuations.

5. Return Potential: Diversification does not guarantee high returns, but it aims to achieve a balance between risk and return. While it might limit the potential for substantial gains, it also reduces the risk of significant losses, making it a suitable strategy for long-term investors seeking a more stable and consistent performance.

6. Correlation: An essential consideration in diversification is the correlation between assets. Ideally, you want assets that do not move in the same direction at the same time. For example, during a stock market downturn, bonds might perform better because they tend to have an inverse relationship with stocks.

7. Rebalancing: Regularly reviewing and rebalancing a diversified portfolio is crucial. Over time, the performance of different assets can lead to deviations from the original asset allocation. Rebalancing involves buying or selling assets to return the portfolio to its target allocation.

8. Customization: Diversification is not a one-size-fits-all strategy. The specific asset classes and individual investments used for diversification should be tailored to an investor’s financial goals, risk tolerance, and time horizon.

9. Risk Tolerance: Diversification can be adjusted to match an individual’s risk tolerance. Some investors may have a higher risk tolerance and include more equities in their portfolio, while others with lower risk tolerance might favor a higher allocation of bonds.

10. Professional Advice: Consider consulting a financial advisor or professional to help design and manage a diversified portfolio that aligns with your investment objectives and risk profile.